In June 2022, a piece of text that supposedly provided "a whole lot of truth about gas prices" was copied and pasted across social media. The text was frequently attributed to a "production worker in a refinery on the Gulf of Mexico," and preceded by the assertion that "you've been lied to by the President and his phony cronies."

There are several misleading or false statements in this post, and we'll take a deeper look at some of those claims below. Generally speaking, however, the overall gist of the post — that high gas prices are "Joe Biden's fault because he is suppressing the domestic oil industry for political gain" — is mostly false. There are a number of factors that have led to an increase in gas prices, according to economists, many of which are not controlled by the president of the United States, such as the cost of crude oil on the global market. It's also worth noting that the United States is not the only country that has seen higher-than-normal gas prices. In fact, in June 2022, the price of gasoline in America was about half the cost of gas in Hong Kong ($11.35), and in 25 other countries -- including Iceland, Greece, the United Kingdom, Ireland, Spain, and France -- average gas prices reached over $8 per gallon.

Origins: 7 'Facts' About Oil Prices

While this piece of copypasta found viral infamy in June 2022, it can be traced back to a social media post from "Lance Geist" that was shared on March 31. That version of the message included a photograph supposedly showing a small bottle of crude oil and two introductory paragraphs providing some biographical information about the author (they claim that they worked on a "production facility" in the Gulf of Mexico) and the claim that crude oil was the most valuable substance in the world. Regardless of where one encountered this message, these 7 "facts" about oil listed therein remained largely unchanged.

Does US Have Enough Recoverable Crude to Last 400+ Years?

There is enough recoverable crude oil within the continental US to supply current and projected future demand for 400+ years, and that's just the oil we know about. It doesn't account for future discoveries. That's a fact, jack.

This is not a fact, Jack.

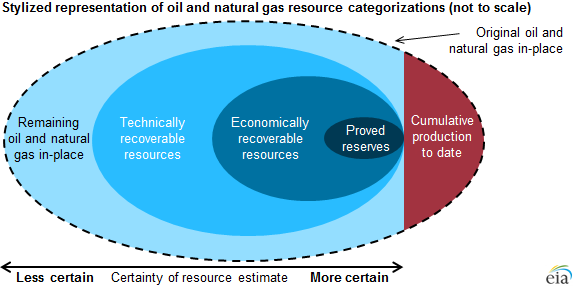

Oil reserves are typically classified into four categories: "Proved reserves," "economically recoverable resources," "technically recoverable resources," and "remaining oil in-place." This viral Facebook post uses the term "recoverable" crude oil. For the purposes of this article, we'll focus on the more generous term "technically recoverable resources," which the United States Geological Society (USGS) defines as oil that "can be produced using currently available technology and industry practices … regardless of any economic or accessibility considerations."

The U.S. Energy Information Administration (EIA) regularly tracks oil production and reserves. According to the EIA's 2022 Assumptions report, the United States has 373.1 billion barrels of technically recoverable crude oil. Is this enough to meet energy demands in the United States for the next 400 years, as the viral post claims?

No.

The United States consumes about 7 billion barrels of oil a year. If that rate of consumption continues into the future, it would take only about 53 years for us to run through all 373.1 billion barrels of technically recoverable crude oil.

When we reached out to the EIA, they confirmed these numbers for us. However, they also insisted that these were just "estimates" and that there were a number of factors that could change the country's energy outlook. It's possible, for example, that we find additional oil reserves, or that technology for extraction improves, allowing us to reach reserves that are not technically recoverable at the moment. Furthermore, we could see changes in consumer patterns that could lessen the amount of oil that we consume every year.

A spokesperson for EIA said:

The U.S. Geological Survey calculates an estimate of technically recoverable resources, which is a measure of the amount of oil and/or gas that can be produced using currently available technology and industry practices. Let me emphasize again that this is an estimate; it’s a highly uncertain figure, and it does not consider how much crude oil is economical to recover.

The USGS estimates technically recoverable reserves of crude oil as 373.1 billion barrels. At current consumption levels, that volume would last about 50 years. That’s one way to look at the question. Of course there are many other factors one could consider, such as how oil consumption would change over the next 400 years, how technology for oil extraction will advance, how USGS estimates could change, etc.

Why Does the US Import Oil?

This viral list argues that while the United States is capable of producing enough oil to meet domestic demand, it is unable to do so because of government restrictions. This is misleading at best.

Robert Kaufmann, a professor with the Earth and Environment Department at Boston University, told Newsweek in March that one of the reasons the U.S. imports oil is because it uses more than it produces. And even if the United States was able to increase production in order to match domestic demand, Kaufmann said, it wouldn't have much of an impact on gas prices.

The U.S. imports oil because consumption of oil products—about 20 million barrels per day—is greater than the quantity of crude oil it produces, about 18 million barrels per day. This difference, about 2-3 million barrels per day, is much smaller than previous years

[...]

The quantity of oil that the U.S. imports has little to no effect on the price we pay for crude oil. There is one global market for crude oil. That global price sets the price for all crude oils, plus or minus a couple of dollars depending on transportation costs and the quality of the crude oil.

Even if the U.S. produced all the oil it needed, U.S. consumers would pay the global price.

It's also misleading to say that the United States can't produce enough oil domestically to meet demand due to government restrictions. A recent survey of U.S. oil producers found that the majority of companies cited "investor pressure" as their reason for not expanding production. Only 6% of those companies cited government restrictions. CBS News reported:

As to why they weren't drilling more, oil executives blamed Wall Street. Nearly 60% cited "investor pressure to maintain capital discipline" as the primary reason oil companies weren't drilling more despite skyrocketing prices, according to the Dallas Fed survey.

Only 11% cited environmental, social or governance issues; 8% said they had difficulty getting financing; 15% cited other reasons.

"Investors in energy stocks have been a bit thrown off by the volatility, so they're looking more for energy firms to pay back down their debt, or return money to shareholders, rather than going and investing in new wells — even if those new wells would be profitable," Ashworth said.

In other words, many companies are choosing to enjoy their high profits rather than increase the supply of oil. That's despite the relatively low oil price they would need to turn a profit. On a different Dallas Fed question, executives said oil prices between $23 and $38 a barrel, on average, would cover the cost of drilling new wells.

Are High Gas Prices Joe Biden's Fault?

Again, the overall point of this viral copypasta is that the current spike in gas prices rests solely on the shoulders of U.S. President Joe Biden. As we've explained above, this argument rests on false and misleading arguments.

The text argues that the most common explanation for high gas prices — a combination of global factors stemming from the COVID-19 pandemic and Russia's invasion of Ukraine — is bunk, and that the real reason is that the Biden administration implemented new restrictions on oil production. That's simply not the case.

Is it true that the Biden administration is restricting oil companies from obtaining new leases to drill for oil, as the text claims? No. While the Biden administration has delayed some new leases to drill on public lands, it also approved 3,557 oil drilling permits during its first year, nearly 900 more than former President Donald Trump did during his first year in office. Furthermore, the vast majority of U.S. oil production is done on private land that is unaffected by such restrictions on new leases. And, as we noted above, the oil companies themselves have stated that investor pressure, not government restrictions, was the biggest factor that was holding up production expansion.

Newsweek reported:

Brett Hartl, the government affairs director at the Center for Biological Diversity, also noted more drilling permits were approved in the first year of Biden's presidency than during his predecessor's first 365 days. The center found the Biden administration approved 3,557 permits for oil and gas drilling on public lands last year, outpacing the Trump administration's first-year total of 2,658.

"As an environmentalist, I wish the administration would crack down on fossil fuel drilling much, much more," Hartl told Newsweek. "I think in the long run, it's super harmful. But it's just not factually accurate for the industry to complain, 'We're so helpless' when they've been given a huge green light over the last year and they're sitting on thousands and thousands of permits to drill. What are they waiting for?"

While the Facebook post contends it is sharing "a whole lot of truth about gas prices," this viral piece of copypasta omits important context and contains misleading or false statements.